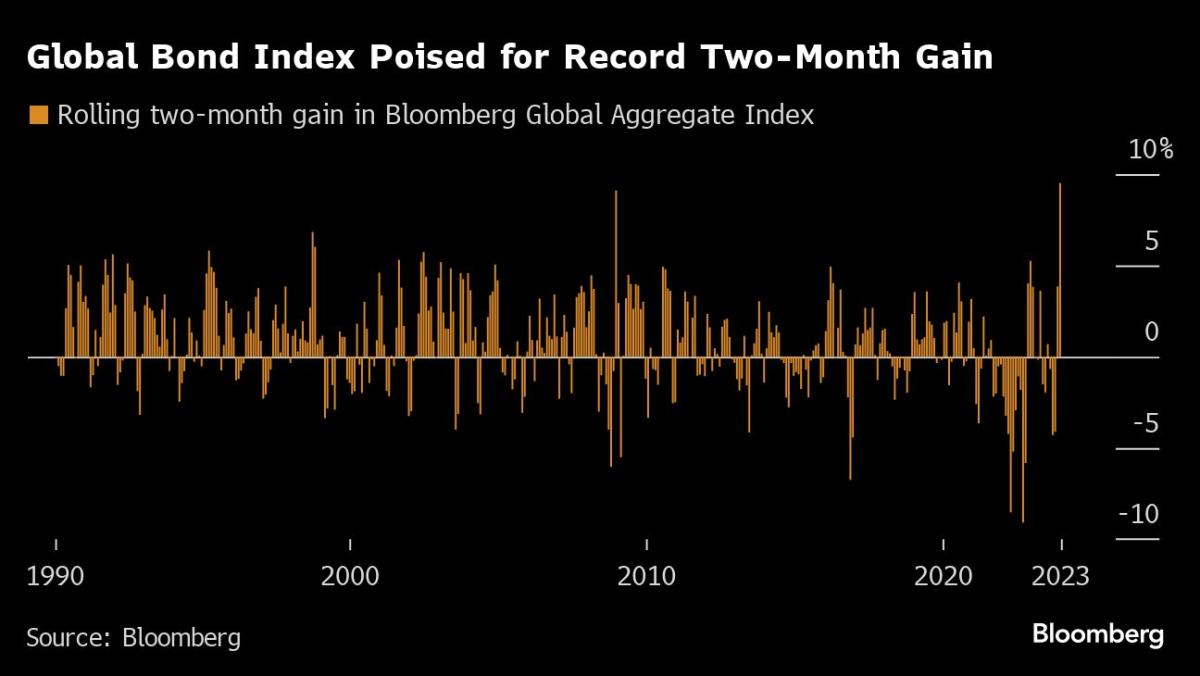

(Bloomberg) -- The world’s debt market is on track to post its biggest two-month gain on record as traders ramp up expectations that central banks everywhere will slash interest rates next year.

Most Read from Bloomberg

The Bloomberg Global Aggregate Total Return Index has risen nearly 10% over November and December, its best two-month run in data going back to 1990.

While bonds pared gains on Thursday, jitters around recession risks are still percolating across markets. That’s underscoring the case to own debt, with traders betting policymakers may have to aggressively cut interest rates next year to bolster growth.

“What we are seeing now is a bond carnival,” said Hideo Shimomura, a senior portfolio manager at Fivestar Asset Management Co. in Tokyo. “Bond investors have been hibernating and now I feel that their explosive desire is to come out of their lair.”

Swaps traders are pricing about 150 basis points of rate cuts in the US and UK next year, and around 170 basis points in the euro zone as investor confidence builds that central banks have won their battle against inflation after embarking on the most aggressive rate-hiking cycles in decades.

Such prospects helped draw strong demand for two- and five-year Treasuries at auctions this week. A sale of seven-year debt later on Thursday is the next test of demand.

Falling yields also drove the greenback lower, sending currencies around the world to multi-month highs and boosting returns on foreign-currency debt. The euro, the yen and the pound are at their strongest levels in at least four months, while the Swiss franc is at the highest since 2015.

The Japanese currency got an additional boost from expectations that the Bank of Japan will raise interest rates for the first time since 2007, with Governor Kazuo Ueda on Thursday further building the case for a move in the spring.

Yields on 10-year US Treasuries, a global borrowing benchmark, have tumbled around 120 basis points from its October peak to around 3.82% in Europe trading on Thursday. US mortgage-backed securities, Treasuries as well as French and German government bonds were the biggest contributors to the index’s gain over November and December, Bloomberg data showed.

Mortgage-backed securities’ strong showing since mid-October defies a textbook theory that they typically underperform other types of bonds when yields are falling. That’s because the securities had been undervalued as their yield spreads widened over Treasuries, said Fivestar’s Shimomura.

“Many investors had been waiting for the time to buy MBS and they rushed to buy them” when the bond market turned, he said.

Investment-grade corporate bonds globally have also rallied, returning almost 11% since the start of November and set for the the best two-month gain on record, based on a Bloomberg index with data going back to 2001. A tightening in spreads has helped credit outperform government debt over that time span.

“The ferocity of the bond market rally has really augmented the total returns for investors,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore. “There’s a feeling markets are signaling we’re heading half-way toward easy monetary policy again.”

--With assistance from Joanna Ossinger, Finbarr Flynn and Aline Oyamada.

(Updates Thursday’s bond moves in third paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

"stage" - Google News

December 28, 2023 at 10:59AM

https://ift.tt/pxmRlNf

Global Bond 'Carnival' Sets Stage for Best Two Months on Record - Yahoo Finance

"stage" - Google News

https://ift.tt/LC4n1XZ

https://ift.tt/Ot9h7ZV

Bagikan Berita Ini

0 Response to "Global Bond 'Carnival' Sets Stage for Best Two Months on Record - Yahoo Finance"

Post a Comment